EQM-Emerita Blockchain BLOK 50 Global Index

Global leaders in the Blockchain ecosystem

View BLOK ETF

Disclosure: The information provided on this page is for illustrative purposes only and is not intended to serve as investment advice. The information provided is as of particular time and subject to change at any time without notice. Values between December 31, 2015 and December 31, 2017 have been calculated pursuant to a backtested methodology. Backtested calculations are prepared with the benefit of hindsight and no hypothetical record can completely account for the impact of financial risk in actual trading. Index returns do not reflect payment of any sales charges or fees an investor may pay to purchase the securities underlying the Index, or investment funds that are intended to track the performance of the Index, the imposition of which would cause actual and back-tested performance to be lower than the performance shown. Past performance of the Index is not an indication of future results.

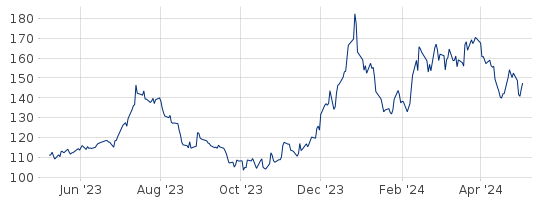

BLOK-50, Last 12 Months

BLOK-50 correlation matrix: below 0.21 with major benchmarks

| Index | BLOK-50 | BITCOIN-USD | S&P 500 | NASDAQ 100 |

| BLOK-50 | 1.00 | 0.16 | 0.21 | 0.19 |

| BITCOIN-USD | 0.16 | 1.00 | 0.00 | 0.02 |

| S&P 500 | 0.21 | 0.00 | 1.00 | 0.88 |

| NASDAQ 100 | 0.19 | 0.02 | 0.88 | 1.00 |

* for period 12/31/15 – 12/31/17

Whitepaper

Methodology

Factsheet

Infograhic

BLOK-50 Index Constituents

| NAME | NUMBER OF SHARES |

| BIGG DIGITAL ASSETS INC | 5.134738 |

| DMG BLOCKCHAIN SOLUTIONS INC | 3.509068 |

| HUOBI TECHNOLOGY HOLDINGS LTD | 2.368304 |

| ARGO BLOCKCHAIN PLC | 2.135218 |

| HIVE BLOCKCHAIN TECHNOLOGIES | 1.803271 |

| BITFARMS LTD/CANADA | 1.442617 |

| EBANG INTERNATIONAL HOLDINGS INC | 1.046735 |

| Z HOLDINGS CORP | 0.988023 |

| WISDOMTREE INVESTMENTS INC | 0.892178 |

| HUT 8 MINING CORP | 0.873893 |

| CONDUENT INC | 0.81408 |

| MOGO INC | 0.704351 |

| DIGINEX LTD | 0.572915 |

| GALAXY DIGITAL HOLDINGS LTD | 0.500743 |

| VOYAGER DIGITAL LTD | 0.473852 |

| OPERA LTD | 0.464598 |

| BIT DIGITAL INC | 0.408482 |

| VPC IMPACT ACQUISITION HLD-A | 0.375558 |

| ONECONNECT FINANCIAL TECHNOLOGY CO LTD | 0.336826 |

| CANAAN INC | 0.257382 |

| CLEANSPARK INC | 0.203747 |

| GMO INTERNET INC | 0.193713 |

| SBI HOLDINGS INC ORD | 0.193713 |

| MARATHON DIGITAL HOLDINGS INC | 0.188571 |

| DIGITAL GARAGE INC | 0.148811 |

| THE9 LIMITED | 0.139999 |

| RIOT BLOCKCHAIN INC | 0.127461 |

| BITCOIN GROUP SE | 0.122961 |

| OVERSTOCK.COM INC | 0.107791 |

| VONTOBEL HOLDING AG | 0.097427 |

| ADVANCED MICRO DEVICES | 0.07078 |

| KAKAO CORP | 0.06778 |

| TAIWAN SEMICONDUCTOR-SP ADR | 0.063266 |

| NORTHERN DATA AG | 0.062241 |

| SILVERGATE CAPITAL CORP | 0.058971 |

| SOFTBANK GROUP CORP | 0.058765 |

| INTERNATIONAL BUSINESS MACHINES CORP | 0.04291 |

| JPMORGAN CHASE & CO | 0.035578 |

| CME GROUP INC | 0.034851 |

| SQUARE INC – A | 0.031763 |

| SIGNATURE BANK | 0.031566 |

| MICROSOFT CORP | 0.030985 |

| PAYPAL HOLDINGS INC. | 0.02975 |

| COINBASE GLOBAL INC -CLASS A | 0.024341 |

| ALIBABA GROUP HOLDING-SP ADR | 0.023418 |

| GOLDMAN SACHS GROUP INC | 0.021056 |

| NAVER CORP | 0.016763 |

| NVIDIA CORP | 0.01444 |

| TESLA INC | 0.01078 |

| MICROSTRATEGY INC-CL A | 0.009519 |

BLOK-50 Index Criteria

Eligibility Requirements

Securities are selected based on the following four criteria:

- Companies actively engaged in the R&D, proof-of-concept testing, and/or implementation of blockchain technology.

- Companies profiting from the demand for blockchain-based applications such as cryptocurrency and mining.

- Companies partnering with and/or directly investing in companies that are actively engaged in the development and/or or use of blockchain technology.

- Member of multiple consortiums or groups dedicated to the exploration of blockchain technology use.

-

Companies are designated as Core blockchain companies if they derive significant direct revenue, as defined by the Index provider, from blockchain-related business and/or are among the largest 5 investors in blockchain-engaged companies as defined by the Index provider.

-

Companies are designated as Non-Core blockchain companies if they directly invest or partner in blockchain technology companies, participate in multiple blockchain industry consortiums, and/or provide consulting services to companies actively engaged in the R&D, proof-of-concept testing, and/or implementation of blockchain technology.

-

Listing on a regulated stock exchange in the form of shares tradable for foreign investors without restrictions.

-

Market capitalization of at least 200 million USD, excluding exchange listed investment vehicles.

-

Minimum price at time of purchase of $3 per share USD, excluding exchange listed investment vehicles.

-

Average daily trading volume of at least 1,000,000 USD over the last six months, excluding exchange listed investment vehicles.

-

Adequate constituent liquidity and accessibility for an exchange listed product as determined by the Index Provider.

-

Non-US companies will be U.S. exchange traded ADR versions if available, assuming they meet

liquidity and accessibility requirements defined previously, otherwise local shares will be utilized that meet these requirements. -

No local shares, only ADRs, will be held for companies domiciled in emerging markets or those listed on small regional exchanges.